How to insure deaths

The death of a loved one is emotionally difficult or difficult to process. If financial concerns are added afterwards, the processing process is often made significantly more difficult. Risk life insurance can of course not change the pain of the bereaved. However, it can ensure that you can focus on grief and not worry about money problems.

Estimated reading time: 6 minutes

Who needs life insurance?

There are many reasons for securing death. The desire most often arises to protect the family’s financial risk when a large investment (e.g. financing a property) is imminent. But general coverage when the main earner dies or other financial obligations also lead to an insurance requirement.

We would like to clear up two errors here:

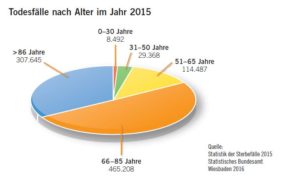

- Fallacy No. 1 – Young people do not need death insurance: unfortunately wrong. In its statistics on deaths, the Federal Statistical Office shows that one in six deaths has not yet reached retirement age.

- Fallacy No. 2 – Only the main earner should be covered: Unfortunately, wrong too. The death of the main earner means that the family’s greatest source of income ceases to exist. However, practice shows that when the partner dies, the main earner has to cut back on work to deal with the grief or take care of the children. For this reason, the partner should also be insured, even if they cannot bring their own income.

What is a Key-Man-Insurance?

Key-man insurance is a special form of risk life insurance. A company secures an important employee without whom business operations would only be possible to a limited extent. The sum insured can either compensate for slumps in sales or hire the right successor.

What types of protection are possible?

Risk life insurance policies can be adapted very precisely to the purpose of the hedge. Most contracts are concluded in one of three classic variants:

- Constant sum of deaths: This solution is usually chosen when the protection is not intended to serve a specific purpose, but rather serves as a backup buffer. The sum insured remains constant over the entire term.

- Linear fall in death total: This is particularly useful if the financial well-being of children should be taken care of when a parent dies. The younger the child, the more money is needed to complete the training. With increasing age of the child, the sum can be melted down annually, since the money no longer has to last that long.

- Annuity-related death total: If the obligations from a (real estate) loan are to be secured, this solution is used. The sum insured is based on the remaining debt of the loan.

In addition, optional insurance sums (i.e. individually adjustable amounts in each insurance year) and time pensions (i.e. payment of a monthly pension instead of a one-off payment) are also offered. However, the number of tariffs is still very limited.

Beware of cheap offers

The risk of death has been researched fairly well in Germany. For this reason, life insurers can calculate their tariffs very precisely. Since they can hardly stand out from the providers through better services, a tough price war is currently taking place. This is generally good for you as a customer, but it also calls up low-cost providers who try to make their contributions appear low with tricks. The 3 most popular tricks are:

- Reduced initial premium: With so-called start tariffs, some insurers appear particularly high in the tariff rankings. The fine print then contains significantly higher contributions that have to be paid after a few years.

- High gross / net difference: Your insurer will show you 2 premiums in the offer. The net contribution indicates how much you actually have to pay. The gross contribution shows a kind of worst-case scenario. If the insurer’s calculation is not successful, he can adjust the payment contribution relatively easily up to the gross contribution. The higher the difference, the greater your cost risk. For some insurers, this is more than 350%!

- Risk-adequate premiums: Life insurance is usually “fully calculated”, i.e. the contribution remains constant over the entire term. Occasionally, however, tariffs also appear where the contribution calculated for the respective age is incurred each year, i.e. it increases from year to year. In the particularly risky years at the end of the contract term, the contribution almost exploded, so that many customers can no longer afford it and give notice.

In individual cases it may make sense to choose such a tariff. However, you should know the risks and details before signing the contract. Unfortunately, many comparison computers on the Internet do not handle this transparently.

How much does risk life insurance cost?

The insurance premium largely depends on the age of entry, the term, the amount insured and smoking behavior. In addition, the job, the family situation, the BMI and risk-relevant hobbies can also play a role.

For example, a 30-year-old person in a commercial profession with no particular risks pays around € 45 a year to cover € 100,000 over 20 years. The contributions are therefore quite manageable and in many cases well invested money.

Insurance coverage options

“Dead is dead” is the motto of most risk life insurance policies. In this respect, the benefit case is quite clearly defined (with the exception of suicides in the first three years). However, more and more insurers are offering additional options to upgrade insurance protection. The most important include:

- Extension option; i.e. the possibility to extend the contract period without a new health check to a certain extent (depending on the tariff)

- Increase option; i.e. the possibility to increase the insured amount to a certain extent (depending on the tariff) without having to undergo another health check if certain life events occur

- Early performance; i.e. the payment of the insurance benefit even before the death, provided that a fatal illness with a short remaining life expectancy (depending on the tariff) is diagnosed

These options usually cost an additional contribution. Whether this is well invested depends largely on the reasons for hedging.

How much do life insurance consultants earn?

The commission rates for such insurance policies vary considerably depending on the provider. They are roughly between 1.5% and 4.5% of the total contribution over the entire term. With an annual contribution of € 250 and a 20-year term, this is between € 75 and € 225. Risk life insurance is therefore not a “big deal” for consultants. If we recommend it, it is not because of monetary interests, but rather because we are convinced of the importance.

Inheritance tax savings through clever contract design

We always find contracts in which the policyholder is also the insured person in life insurance. Most insurance policies are probably designed in this way. So far so normal. In practice, however, this creates a problem for the beneficiary:

In this case, the sum insured must be taxed according to today’s legal opinion. If the tax-free allowances for inheritances have been used up (e.g. because a property is also inherited or because there is no close relationship), a considerable inheritance tax is very quickly accrued.

The current allowances are:

- Spouse or life partner: € 500,000

- Children: € 400,000

- Grandchildren: € 200,000

- Parents: € 100,000

- Other people: € 20,000

(As of 07.2019)

This problem can be solved by clever contract drafting right from the start. Ideally, the person to be insured (e.g. husband) will only be an “insured person”. Policyholder, premium payer and beneficiary in the event of death become person 2 (e.g. wife). According to today’s legal opinion, this construction does not trigger a taxable inheritance, but rather a tax-free insurance benefit. This construct is usually incompatible with the so-called “connected life”. Therefore, the completion of this variant should be considered carefully.

The thing about smoking behavior

Statistically speaking, smokers have a significantly shorter life expectancy than non-smokers. This is well known, of course also to the insurers. Therefore, smokers pay a significantly higher insurance premium than non-smokers. When concluding the contract, depending on the provider, you must therefore state whether you have been a non-smoker for at least 1, 3 or 10 years. If so, you are entitled to the cheaper non-smoking tariff.

However, the conclusion of the contract is not enough. Most of the conditions require a change of smoking behavior – over the entire term of the contract. If you become a smoker again and do not report this, there is a risk of significant cuts in the event of a benefit.

We have described here that smoking can not only lead to higher insurance premiums, but also to problems in the event of claim (German language): https://tbo-versicherungsmakler.de/blog/2016/08/31/rauchendeeltern/

The mistake with accident insurance

Surprisingly often, new customers show us accident insurance policies with extremely high sums of death of several € 100,000. The reason for this is the belief that accidents in particular are the cause of deaths. Employees in the field, in particular, often hedge their risk of death. Many companies also offer their employees protection through accident death insurance.

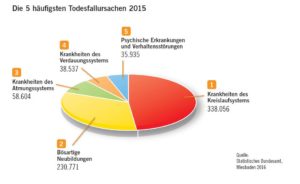

The problem with this: Few people die statistically from accidents. Circulatory system diseases, cancer and other diseases lead to death much more often:

Only real risk life insurance can properly cover the risk of death. You can find out which components really belong in accident insurance here (German language): http://tbo-versicherungsmakler.de/unfallversicherung

Risk life insurance without a health check

If there are significant previous illnesses, there is often a call for death insurance without a health check. First of all: A “real” life insurance with a relevant high insurance sum is currently not available on the market. Nevertheless, there are solutions to get insurance coverage without answering health questions:

- Pension insurance with death benefits: When taking out private pension insurance with relatively high monthly premiums, quite a lot of death sums can be built into some tariffs.

- Death benefit insurance: Many tariffs do without a health check altogether. However, the maximum insured amounts are regularly quite low at € 10,000.

In both cases, there is usually a waiting period (e.g. one, three or five years) in which no death benefit is paid.

Tariffs with a simplified health check often offer a better alternative. Depending on the provider, these are offered to particularly young customers, new parents or people who have just purchased a property.

Do you have questions about risk life insurance or would you like advice? Then feel free to contact us.